Spotlight on communication towers: why are they so exciting?

Mobile phone towers might not strike investors as too exciting until they look at the fundamentals and growth outlook for this vibrant sector. Natasha Thomas, Portfolio Manager, Energy & Communications at Ausbil Global Infrastructure, shares the compelling opportunity in communications infrastructure.

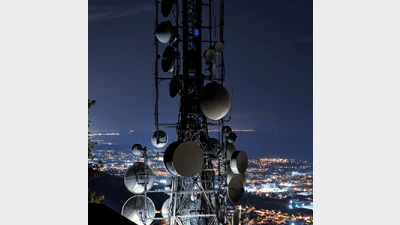

Q: Back to basics, what exactly does a communication tower or mobile phone tower company do?

A: A mobile phone tower is a vertical structure built on a parcel of land. This structure, and the ground interest on which it stands, is typically owned or leased under a long-term contract by the mobile phone tower company. The mobile phone tower company then leases the vertical space on the tower and portions of the land at the base of the tower to tenants, primarily telecom service providers. Most towers have the capacity to support 4 to 5 communication’ tenants. The tenant owns and is responsible for operating and maintaining the equipment that they install on the tower, not the infrastructure operator, including antennas and coaxial cables, as well as the equipment shelters at the base of the tower. This means that there is significantly less risk in owning the infrastructure as any problems with the wires and boxes are for the telecom service provider leasing the space.

Q: Why do mobile phone tower companies fit our definition of Essential Infrastructure?

A: The characteristics of the mobile phone tower industry fit squarely within Ausbil’s strict definition of Essential Infrastructure. The reason for this is two main characteristics that can be observed in these tower assets. The first characteristic is the asset’s strong recurring cash flow characteristics. The contracts between the tower companies and their telecommunication company tenants are long-term and cannot be cancelled. In addition, they have annual price escalators (clauses that allow for increases to agreed fees) embedded in these contracts providing inflation protection (we talk more about this later). Incremental cash flow margins are high, as adding new customers to an existing tower comes with little to no additional operating cost, and maintenance capex is low. The second characteristic that for us determines that towers are Essential Infrastructure is the high barriers to entry. The towers are a location-based business, typically with significant zoning restrictions. Coupled with the capital and time required to build-out a tower network of meaningful scale, it would be very challenging for a new entrant to start up and replicate an existing tower network. This helps drive high contract renewal rates by the tenants on the towers.

Q: What attractive investment opportunities are you seeing in the global listed tower sector?

A: Across the sector there is a multiplicity of attractive investment opportunities, so instead of going through them all, we’ll focus on two…

Recommended for you

Everyone has their own reason for wanting to stay healthier, for longer.As a super fund, you're in a unique position to ...

The evolution of financial technology continues accelerating with the emergence of high-speed blockchain networks that e...

Australian property prices are rising again, presenting a compelling opportunity for investors. For the first time in fo...

For the first time in four years, every Australian capital city recorded simultaneous quarterly price growth—fuelle...