Double digit boost for super funds

Super fund members can anticipate double digit returns second year in a row with early estimates showing the median fund in the growth category will return about 13 per cent to 30 June.

The latest data by Chant West showed some of the better-performed funds (61 to 80 per cent allocation to growth assets) could record as much as a 16 per cent growth.

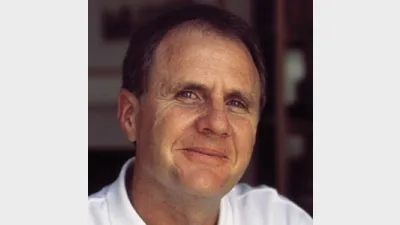

Chant West director Warren Chant said super funds have seen five consecutive years of positive returns following the global financial crisis setbacks, totalling 58 per cent overall.

“That works out at 9.6 per cent a year, which is well above the typical growth fund objective of 6.5 per cent to 7 per cent a year,” he said, adding this is comfortably above inflation, which has averaged 2.7 per cent during this time.

Chant said the key drivers were listed shares and property, which had a 57 per cent allocation.

Australian shares rose by 18.3 per cent over the year, while international shares climbed 21.8 per cent in hedged terms and 20.5 per cent on an unhedged basis.

Chant warned, however, that share markets have been sombre and more volatile in the past six months.

“With more modest share market returns expected, super fund members shouldn’t be counting on a repeat of the double digit returns of the past two years.”

Recommended for you

The structural shift towards active ETFs will reshape the asset management industry, according to McKinsey, and financial advisers will be a key group for managers to focus their distribution.

ASIC has warned that practices across the $200 billion private credit market are inconsistent and, in some cases, require serious improvement.

A surge in electricity prices has driven the monthly Consumer Price Index to its highest level in a year, exceeding forecasts.

Infrastructure well-positioned to hedge against global uncertainty, says investment chief.