Real asset demand on the rise: AMP Capital

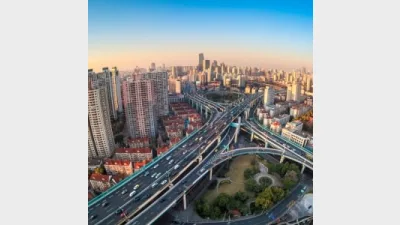

The demand for real assets will continue to strengthen next year, following a surge in mergers and acquisition activity, urbanisation and infrastructure spend globally, according to AMP Capital.

A report, prepared by AMP Capital on the outlook for real assets in 2016, detailed a series of key trends set to influence the sector, including: intense competition for "trophy assets" and high-quality Australian property, the US Federal Reserve's movements on rates, increased mergers and acquisitions activity and privatisation, a "lower for longer" yield environment, as well as urbanisation and infrastructure spend.

According to AMP Capital's global head of infrastructure equity, Boe Pahari, infrastructure is a defensive asset class that is "highly competitive" with this competition set to intensify over the next 12 months as more funds are launched by managers.

"There is more money than ever before to invest in infrastructure. In addition, we are seeing a growing preference from large investors, particularly sovereign wealth funds and pension funds, to invest directly in infrastructure assets," Pahari said.

"This increased activity across the asset class is putting upward pressure on pricing across most sectors, particularly large energy, utilities and transport assets."

AMP Capital global head of infrastructure debt, Andrew Jones, said that 2016 is expected to provide a "strong pipeline" of investment opportunities as a result of mergers and acquisitions activity and privatising programs driving increased global activity in the infrastructure debt sector.

"In the senior debt space, we expect liquidity from banks to continue to drive returns lower as competition for high-quality assets continues," Jones said.

"In the less competitive mezzanine space, we expect returns to continue to be attractive, particularly on a risk-adjusted basis. Investors in infrastructure debt are looking for investments with high yield and stable returns."

Recommended for you

APRA’s executive director has urged super funds to strengthen leadership, operational resilience and member focus as public trust in the system faces fresh challenges.

The firm has appointed Aware Super’s Damian Graham as group chief investment officer to unify its life and funds management teams.

Ethical super fund Australian Ethical has announced the appointment of Anthony Lane as chief operating officer.

The structural shift towards active ETFs will reshape the asset management industry, according to McKinsey, and financial advisers will be a key group for managers to focus their distribution.