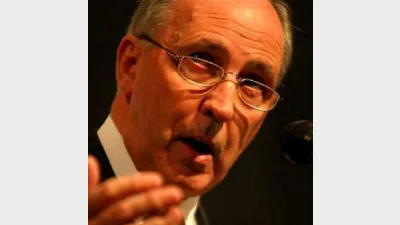

Keating calls for further super measures

The former Prime Minister and Treasurer, Paul Keating, has called for Australia to pursue a sustainable post-retirement incomes regime beyond the current compulsory superannuation system.

Addressing the opening plenary of the Association of Superannuation Funds of Australia national conference, Keating advocated the pursuit of policies entailing the use of deferred annuities to cover the needs of those living beyond 85, or alternatively an additional 3 per cent of wages being contributed to a Government-run insurance pool.

He said that while lifting the superannuation guarantee to 12 per cent was welcome, it was not going to be enough to meet Australia's longevity challenge.

The former Prime Minister acknowledged that the original superannuation system had simply not envisaged the longevity issue.

Keating was also critical of the Gillard Government's decision to cut concessional contributions and argued that it would not allow for the de-risking of the age pension.

He said that those aged over 50 should be able to contribute as much as $100,000 if they wanted to.

Keating said the Government's desire to reduce pressure on the Budget was understandable, but failed to take appropriate account of the out-lying years.

Recommended for you

Australia’s superannuation funds are becoming a defining force in shaping the nation’s capital markets, with the corporate watchdog warning that trustees now hold systemic importance on par with banks.

Payday super has passed Parliament, marking a major shift to combat unpaid entitlements and strengthen retirement outcomes for millions of workers.

The central bank has announced the official cash rate decision for its November monetary policy meeting.

Australia’s maturing superannuation system delivers higher balances, fewer duplicate accounts and growing female asset share, but gaps and adequacy challenges remain.