NAB/MLC retained grandfathering to retain planners

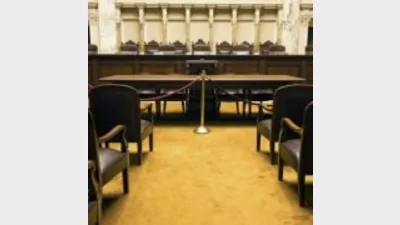

NAB/MLC decided to pursue keeping grandfathered payments to financial planners as part of a successor fund transfer (SFT) process because of its concern that planners and their clients would take their business elsewhere, the Royal Commission was told today.

Giving testimony before the Royal Commission into Banking, Superannuation and Financial Services, former MLC/NAB executive, Paul Carter acknowledged that it had been open to NAB/MLC to abandon the grandfathered payments, but it had chosen not to.

He said that this was because of the contractual arrangements with the planners and the likelihood the planners would be dissatisfied and take their business elsewhere.

However, Carter later acknowledged under questioning from counsel assisting the Royal Commission, Michael Hodge QC, that contractual arrangements with the planners would not have been an issue for the trustee of the fund, NULIS.

Hodge asked whether, given advisers’ best interest obligations, it would have been wise to move clients out of commission arrangements.

Carter said he believed the two positions could be reconciled because of the MLC products were available to the clients.

Seeking clarification of what had occurred, the Royal Commissioner, Kenneth Hayne sought clarity from Carter around what had been pursued was a platform transfer rather than a successor fund transfer.

Recommended for you

Australia’s largest super funds have deepened private markets exposure, scaled internal investment capability, and balanced liquidity as competition and consolidation intensify.

The ATO has revealed nearly $19 billion in lost and unclaimed super, urging over 7 million Australians to reclaim their savings.

The industry super fund has launched a new digital experience designed to make retirement preparation simpler and more personalised for its members.

A hold in the cash rate during the upcoming November monetary policy meeting appears to now be a certainty off the back of skyrocketing inflation during the September quarter.