Plum launches new retirement income product

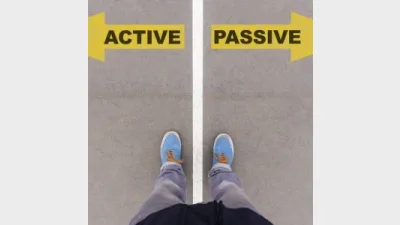

Plum Super has launched a new account-based pension to cater for both active and passive investor types.

The Plum Retirement Income (PRI) offered two investment paths, the cultivator investment path and the self-select investment path.

The cultivator offers members an automated investment and drawdown strategy, designed to deliver short-to-medium-term income stability and long-term capital growth with aims to optimise retirement income to last as long as possible.

The self-select relies on the member to select and monitor their investment portfolio and offers five investment levels designed to offer flexibility in investing to meet their retirement needs.

NAB general manager of customer experience, superannuation, Lara Bourguignon said: “Our absolute focus remains on helping our members enjoy their retirement and offering products that provide flexibility, choice, and support”.

PRI also provides members with access to phone-based help, online education, and an electronic application process.

Recommended for you

The central bank has announced the official cash rate decision for its November monetary policy meeting.

Australia’s maturing superannuation system delivers higher balances, fewer duplicate accounts and growing female asset share, but gaps and adequacy challenges remain.

Global volatility and offshore exposure have driven super funds to build US-dollar liquidity buffers, a new BNY paper has found.

Less than two in five Australians are confident they will have sufficient assets to retire and almost three-quarters admit they need to pay greater attention to their balance, according to ART research.