REST joins anti-slavery coalition

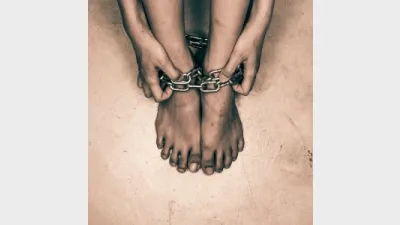

Industry superannuation fund REST has joined the Investors Against Slavery and Trafficking (IAST) APAC coalition in an effort to strengthen its commitment to responsible investing.

The IAST urges companies to pursue action to combat modern slavery, human trafficking and labour exploitation in its supply chains.

REST and 32 other institutional investors and super funds in Asia Pacific signed up to the coalition.

REST chief investment officer, Andrew Lill, said: “Organisations of our scale and reach must proactively take steps that can reduce modern slavery and trafficking. We believe that being a responsible investor is critical to providing long-term returns to our members. What’s more, our members have told us they expect us to invest responsibly.

“Addressing potential modern slavery exposures in your investments, operations and supply chain, and engaging with businesses to ensure they’re also taking similar action, is a core component of being a responsible investor.”

The fund, which had $60 billion in assets, had also developed a modern slavery action plan and supplier code of conduct, and would be publishing efforts undertaken by the fund in this regard in the 2019/20 financial year.

This included reviewing potential exposures within the REST investment portfolio including any risks associated with investment managers.

Recommended for you

The central bank has announced the official cash rate decision for its November monetary policy meeting.

Australia’s maturing superannuation system delivers higher balances, fewer duplicate accounts and growing female asset share, but gaps and adequacy challenges remain.

Global volatility and offshore exposure have driven super funds to build US-dollar liquidity buffers, a new BNY paper has found.

Less than two in five Australians are confident they will have sufficient assets to retire and almost three-quarters admit they need to pay greater attention to their balance, according to ART research.