September subdued for super funds: Chant West

Nervousness and risk aversion among investors saw super funds lose ground in September compared to the first two months of the financial year, Chant West reported.

The median growth fund (61 to 80 per cent growth assets) recorded a 1.7 per cent gain for the September quarter, which Chant West called respectable.

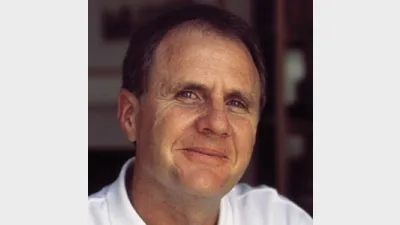

"Fear and volatility returned to global markets in September, and that mood has only deepened in October so far," Chant West director Warren Chant said.

While investors remained "reasonably sanguine" about the economic outlook for the first two months of the financial year as they focused on the recovering US economy, they could not ignore the fact that Europe risked going back into recession and/or deflation.

Listed shares and property markets were the biggest contributors to September's growth fund performance, with Australian shares falling 0.6 per cent partly due to falling commodity prices, but also because investors are scurrying to the safety of bonds.

International shares rose 0.9 per cent in hedged terms, and 5.7 per cent in unhedged terms due to the steep decline of the Australian dollar.

Australian listed property had positive returns of 1.2 per cent, while international listed property went back 1.3 per cent.

Industry and retail funds were neck and neck in the September quarter, returning 1.7 per cent and 1.6 per cent respectively.

But over 15 years, industry funds returned an annualised 7.1 per cent, while retail funds returned 6 per cent.

Recommended for you

A ratings firm has placed more prominence on governance in its fund ratings, highlighting that it’s not just about how much money a fund makes today, but whether the people running it are trustworthy, disciplined, and able to deliver for members in the future.

AMP has reached an agreement in principle to settle a landmark class action over fees charged to members of its superannuation funds, with $120 million earmarked for affected members.

Australia’s second-largest super fund is prioritising impact investing with a $2 billion commitment, targeting assets that deliver a combination of financial, social, and environmental outcomes.

The super fund has significantly grown its membership following the inclusion of Zurich’s OneCare Super policyholders.