Super funds gain 0.5 per cent in May

Superannuation funds are on track to producing strong double-digit returns for the financial year after the 11 months of the financial year returned 10.4 per cent, according to Chant West.

Chant West’s latest report found the median growth fund (61 to 80 per cent growth assets) gained 0.5 per cent in May.

The report said listed shares, which were the main drivers of growth fund performance, produced mixed results in May. Australian shares fell 2.7 per cent over the month, international shares were up 1.6 per cent on a hedged basis and was at 2.8 per cent in unhedged terms due to the depreciation of the Australian dollar. Australian real estate investment trusts (REITs) were down one per cent, and global REITs up 0.5 per cent.

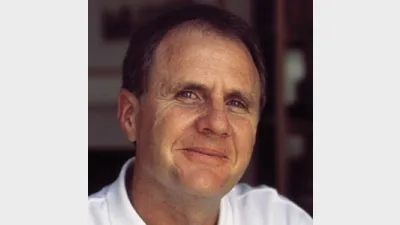

Chant West director, Warren Chant, said the year’s performance came off the back of a seven-year run where growth funds returned an average of 8.8 per cent per annum.

“This year looks like increasing that average. Funds are performing well above the rate of inflation and well ahead of their own inflation-adjusted targets. That’s really impressive, especially since we’ve been through a long period of uncertainty, both economic and political,” Chant said.

“We’re not out of the woods yet, but the economic indicators are certainly looking better now than they were a year ago.”

The report also found that industry funds outperformed their retail counterparts in May, with a return of 0.6 per cent versus 0.3 per cent respectively.

Industry funds also held the advantage over the longer term, with a 5.2 per cent per annum return compared to 4.4 per cent for retail funds over the 10 years to May 2017.

Recommended for you

The Gateway Network Governance Body has unveiled a detailed roadmap to guide the superannuation industry through the upcoming Payday Super reforms.

CPA Australia urges the ATO to extend compliance support for small businesses facing major system changes ahead of Payday Super reforms.

Superannuation funds ramp up collective efforts to counter rising cybercrime, updating standards and sharing intelligence across the industry.

The regulator has fined two super funds for misleading sustainability and investment claims, citing ongoing efforts to curb greenwashing across the sector.