The global financial crisis (GFC) ravaged the retirement savings of most Australians.

A lot of us are looking at 10-year super returns barely above the returns from cash, and certainly below returns from bonds.

A tough pill to swallow if you’re over 10 years from retirement — and a devastating outcome if your twilight years are closer.

There is no doubt the traditional risk management approaches of diversification and tail risk hedging failed dismally as markets fell.

I argue a new approach to managing risk and volatility is essential to ensure future generations are protected.

One such solution is constructing a portfolio of highly liquid, exchange-traded options to dynamically adjust portfolios based on a fund’s risk profile.

This approach provides superior outcomes to diversification and tail risk hedging by reducing volatility and ultimately benefiting long-term investors such as superannuation funds.

Options are often misunderstood, but they are the most effective tool to manage volatility because they can reshape portfolio distributions more reliably than simply diversifying assets.

How options can reduce volatility

Because index options are often not fairly priced, options can be a highly effective tool for volatility management.

A persistent overvaluation stems from a shortage of those willing to supply options versus those wishing to buy them, opening up opportunities for skilled investors to find sources of alpha.

As an example, since 1990 the implied volatility (used in pricing options) was greater than the volatility subsequently realised by the S&P500 87 per cent of the time.

In other words, the put option on the S&P500 is overpriced 87 per cent of the time — demonstrating the level of mispricing and therefore available alpha.

For those with the appropriate experience, capturing this alpha can help to reshape profit profiles and reduce portfolio volatility without diminishing expected returns.

The other side to this strategy is that, technically, an investor could keep portfolio volatility the same and use options to increase returns.

The advantage of an option-based solution is it can be totally customised for an investor’s risk and return profile, ultimately leading to better outcomes than diversification or simple put buying strategies provide (ie, tail risk hedging).

Diversification fails when you need it most

While risk reduction through diversification of a portfolio’s assets still has merit, ultimately it is a blunt tool. Cross-correlations between assets and markets have steadily increased during the last few decades eroding the benefits of diversification.

This was apparent during the global market declines of 2001 and 2008 when correlations spiked and the weakness of diversification was exposed.

These events seem to suggest that portfolio diversification is not enough to protect returns during extreme market events.

There has been interest in recent times for strategies such as tail risk hedging, but the results show this approach also falls short.

The problem with tail risk hedging

Tail risk hedging strategies buy put options to cut the distribution of returns to the left, avoiding extreme losses. However, buying put options month after month becomes very expensive (they are overpriced 87 per cent of the time).

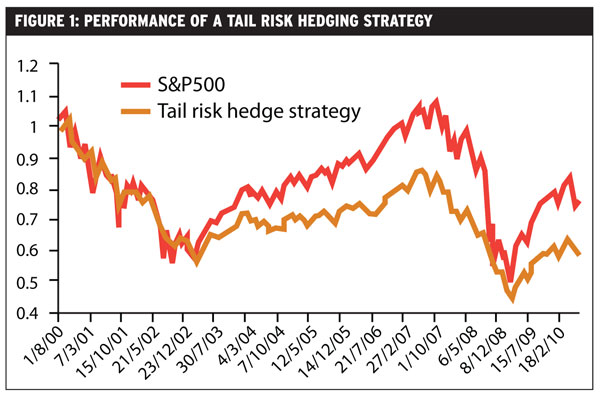

Most importantly, the solution is static and does not accommodate specific portfolio requirements, as shown in figure 1.

Although the strategy reduced volatility of monthly returns by 40 per cent, it also severely impacted returns.

Looking at the graph more closely, very rarely did the tail risk hedging strategy exceed the S&P500 and actually underperformed for large periods.

The reason tail risk hedging does not work can be explained by the way options are priced. While the one month put option cushioned the portfolio initially from a downturn, subsequent one-month options become expensive during volatility and are purchased at exorbitant prices, impeding returns.

Options in action

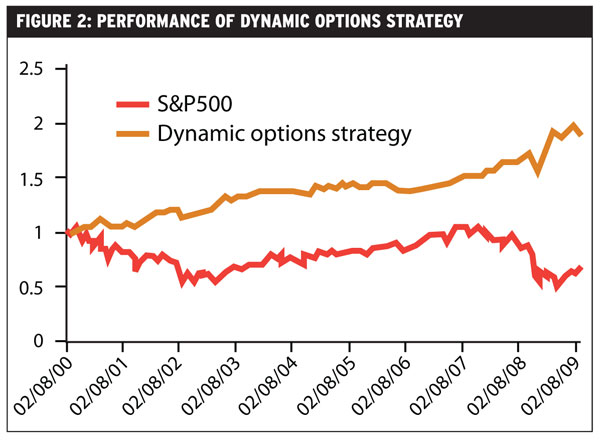

The strategy is based on the principles of dynamic asset allocation in that it takes a flexible and customisable approach to portfolio weights depending on economic conditions, maximising returns subject to pre-defined levels of volatility.

If we take a portfolio comprising of the S&P500 and add a basket of call and put options to dynamically reshape the distribution curve, volatility reduction and superior long-term returns can be achieved.

Ultimately, this strategy is designed to cushion a portfolio from extreme fluctuations — making it incredibly valuable during flat and bear markets.

Of course in contrast, the strategy is likely to underperform its benchmark during extreme bull markets (as can be seen in figure 1 between 2003 and 2007).

But that’s the price you pay to avoid devastating market losses like those recorded in 1987, 2001 and 2008.

Options are a formidable tool in managing volatility and risk if used in the correct way.

Although often misunderstood, funds with long-term horizons should consider using a dynamic options strategy, as it can be an optimal way to ensure long-term returns for investors.

Simon Ho is executive director of volatility management specialists Triple 3 Partners.