The newspaper headline said all you needed to know about the final report of the Financial Systems Inquiry – "Murray orders super overhaul".

But what if the FSI's analysis of what ought to happen with respect to superannuation was largely premised on a misconception – the misconception that the Australian superannuation industry is in some way inefficient and charging higher fees.

And if such a misconception existed in the minds of those forming the FSI panel, then it had its genesis in research provided by the Grattan Institute which has been the subject of considerable criticism that it was premised on inappropriate comparisons.

This much was made clear during this year's Super Review roundtable conducted during the Association of Superannuation Funds of Australia (ASFA) conference where the panellists broadly agreed that there was a danger that the final report generated by the FSI process would be unduly influenced by the Grattan Institute analysis.

Deloitte partner, Russell Mason said that the reliance on the fee research in the FSI interim report had been very frustrating.

"Costs of Australian super funds are not high and that was a very frustrating aspect of the interim report," he said. "You look at investment – you break up investment management fees we've got some of the most competitive fees – the administrators' fees; the insurance – they're competitive."

Mason said it was inappropriate to compare Australian industry funds such as NGS Super or SunSuper with closed defined benefit funds in Europe.

"I mean its chalk and cheese where these employers absorb a lot of all the costs. I can show you a nil cost fund in Europe because of the way the funding is worded," he said "We have choice of funds. We have portability. We have a financial plan embedded in our funds. We have investment choice. We have insurance variation choice. A whole lot of things."

Pillar Administration chief executive, Peter Brooke agreed with Mason and said there was a danger of making the wrong comparisons.

"I'm concerned that the debate gets lost in some of the haze. You talk about Chile and you talk about all these sorts of superannuation offers but it's not a correct juxtaposition and I think that unless that's clearly explained we'll end up with some wrong results," he said.

The roundtable participants concluded that a significant contributor to superannuation costs in Australia had been the significant regulatory changes enforced on the industry.

However when the FSI final report was released early December it became clear that while the inquiry panellists may have received submissions with regard to the inadvisability of comparing closed, defined benefit funds in Europe with the highly active defined contributions funds in Australia, it had not significantly altered their view.

The thrust of the FSI final recommendations was that the Australian superannuation system, while delivering many benefits, remained inefficient.

The FSI report made this point clear in its opening analysis, stating:

"An efficient superannuation system is critical to help Australia meet the economic and fiscal challenges of an ageing population. The system has considerable strengths. It plays an important role in providing long-term funding for economic activity in Australia both directly and indirectly through funding financial institutions, and it contributed to the stability of the financial system and the economy during the global financial crisis.

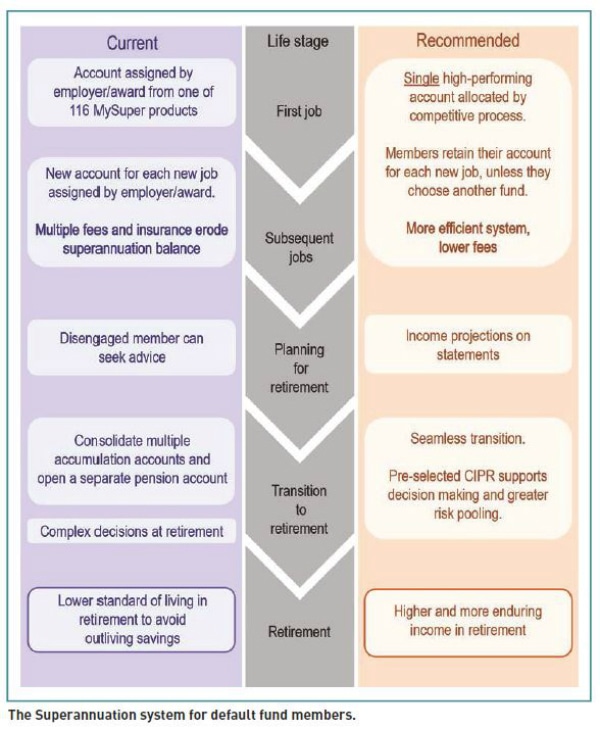

"However, the superannuation system is not operationally efficient due to a lack of strong price-based competition. Superannuation assets are not being efficiently converted into retirement incomes due to a lack of risk pooling and over-reliance on individual account-based pensions.

"The Inquiry's recommendations to strengthen the superannuation system aim to:

- Set a clear objective for the superannuation system to provide income in retirement.

- Improve long-term net returns for members by introducing a formal competitive process to allocate new workforce entrants to high-performing superannuation funds, unless the Stronger Super reforms prove effective.

- Meet the needs of retirees better by requiring superannuation trustees to pre-select a comprehensive income product in retirement for members to receive their benefits, unless members choose to take their benefits in another way.

These recommendations seek to improve the outcomes for superannuation fund members and help Australia to manage the challenges of an ageing population.

Where the FSI recommendations did succeed in resonating with superannuation fund executives and trustees was where they touched on the taxation regime around super.

As acknowledged in submissions, superannuation is seen as an attractive savings and wealth management vehicle for middle- and higher-income earners due to the highly concessional tax treatment of contributions and earnings, it said.

"Superannuation tax concessions are not well targeted at the objectives of the superannuation system," it said.

"¬ a small minority of members hold a high proportion of superannuation assets. Individuals with very large superannuation balances are able to benefit from tax concessions on funds that are likely to be used for purposes other than providing retirement income, such as tax-effective wealth management and estate planning."

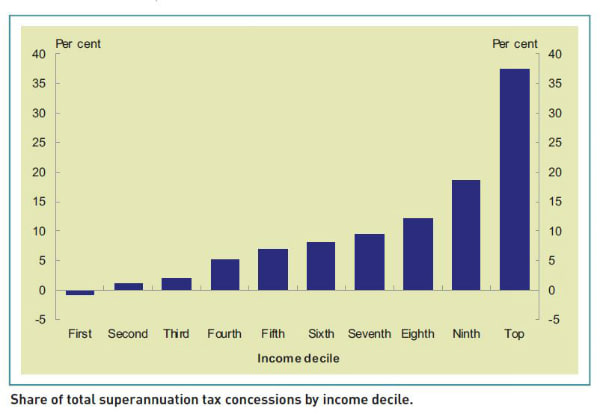

"As a result, the majority of tax concessions accrue to the top 20 per cent of income earners. These tax concessions are unlikely to reduce future Age Pension expenditure significantly."

It said that poorly targeted tax concessions increased the cost of the superannuation system to Government and that this, in turn, increased the fiscal pressures on Government from an ageing population.

"Giving high-income individuals larger concessions than are required to achieve the objectives of the system also increases the inefficiencies that arise from higher taxation elsewhere in the economy, including differences in the tax treatment of savings," it said.

"In addition, tax concessions contribute significantly to policy instability and undermine long-term confidence in the superannuation system," the final report said.

It noted that around half of the announced policy changes over the past 10 years appeared to have been aimed at addressing concerns related to the targeting and equity of tax concessions.

"Despite this, concerns remain and continue to undermine public confidence in the fairness and sustainability of policy settings," the report said. "The differential tax rates on earnings between the accumulation phase (taxed at 15 per cent) and the retirement phase (tax-free) of superannuation have adverse effects as they:

- Create a tax boundary that limits pension product innovation and acts as a barrier to funds offering whole-of-life superannuation products. This increases costs in the superannuation system by requiring multiple, separate accounts between the accumulation and retirement phases.

- Can contribute to sub-optimal investment strategies in the years approaching members' retirement by focusing attention on investing until the point of retirement (the end of the accumulation phase), rather than investing over the long term beyond the point of retirement.

- Provide an opportunity for tax arbitrage in superannuation between the accumulation and retirement phases. Capturing these benefits by allocating specific assets to individuals can result in a shift away from investment pooling and diversification in superannuation and reduce the efficiency of the system. It can also provide non-neutral outcomes between different types of funds, as mentioned in the Interim Report.

The FSI report has recommended a number of ways of overcoming the problem including taking on board suggestions in some submissions with respect to aligning the earnings tax rate between the accumulation and retirement phases

"Aligning the earnings tax rate could be revenue-neutral for Government, would reduce costs for funds, would help to foster innovation in whole-of-life superannuation products, would facilitate a seamless transition to retirement and would reduce opportunities for tax arbitrage," it said.

However it also noted that "a positive tax rate in retirement could reduce equity for some lower-income individuals taking income streams".

The report also canvassed the better target tax concessions including reducing the non-concessional contribution cap and better targeting superannuation contribution tax concessions

"Some submissions suggest applying a more neutral tax treatment of superannuation across taxpayers. This could be done by implementing the AFTS recommendation to tax superannuation contributions at marginal rates less a flat-rate rebate," it said.

"Tightening the non-concessional contribution cap — currently $540,000 over three years — would help to target the tax concessions for superannuation contributions better by reducing the extent to which individuals could accrue very large balances in the system in the future."

"The administrative and compliance costs would be relatively low. However, it would reduce individuals' flexibility to save for their retirement at different times of their life and could adversely affect individuals with broken work patterns."

The report also traversed the strategy of the former Labor Government of levying additional earnings tax on superannuation account balances above a certain limit

However, it noted that similar policy proposals in the past had not succeeded due to their complexity and the high costs of implementation.

"Industry express a strong view that imposing a different rate of earnings tax inside a pooled superannuation trust based on members' individual incomes would impose high compliance costs and complexity on funds. Submissions also stress the need to avoid options that impose large compliance costs on funds."

"To avoid these large compliance costs, stakeholders raise alternative implementation options to which the Inquiry is attracted," the report said.

"One approach is to apply the higher rate of earnings tax to affected individuals outside the superannuation system, with the option of paying the tax liability out of superannuation benefits — similar to the mechanism for applying the tax on excess contributions. To reduce complexity further, the tax could be calculated on a simplified tax base.112 This option would increase Government revenue.

The inquiry report concluded that superannuation taxation arrangements should be reformed to place policy settings on a more sustainable footing over the long term.

"Superannuation tax arrangements should be targeted to achieve the objectives of the superannuation system, reduce the cost of the retirement income system to Government, better position Australia to meet the fiscal challenges of an ageing population and reduce funding distortions in the economy," it said.

"The choice between options to better target superannuation tax concessions rests partly on the treatment of very large superannuation balances already in the system, which are likely to be used for purposes other than providing retirement incomes.

"Tighter contribution limits could reduce the future prevalence of very large superannuation balances. On the other hand, account balance limits would address the disproportionate allocation of tax concessions to individuals with very large balances now and in the future, and reduce the costs of these concessions.

"The Inquiry has not recommended a specific option because a range of relevant considerations fall outside its scope — in particular, interactions and alignment with the broader taxation system."