Industry superannuation funds that sponsor major sporting teams might be running contrary to the wishes of their members and, in some cases, their trustees, according to a survey conducted by Super Review.

The survey, conducted during the Conference of Major Superannuation Funds in March, revealed significant antipathy towards sporting sponsorships even before the National Rugby League salary cap scandal blew up around the Melbourne Storm — a team sponsored by Hostplus and an industry funds-backed bank, ME Bank.

Both Hostplus and ME Bank withdrew their sponsorship in the wake of the salary cap scandal, but the Super Review survey had already revealed that many within the superannuation funds industry thought such expenditures were inappropriate.

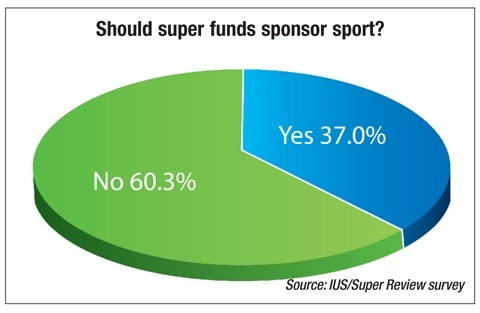

Asked in the IUS/Super Review survey whether superannuation funds should be spending money on sporting sponsorships, a full 60.3 per cent of respondents answered ‘no’, with 37 per cent suggesting they believed it was appropriate and the remainder not having an opinion.

Importantly, more than 50 per cent of the respondents to the survey described themselves as being either superannuation fund trustees or superannuation fund executives.

The negativity around sporting sponsorships within the superannuation funds industry has come at the same time as some financial planners have suggested industry funds are being hypocritical within their message of “all benefits to members” when they are spending their members’ money on sponsoring sports teams.

However, the negativity around sporting sponsorships did not extend to the amount of money spent by funds on television advertising.

Asked whether funds should be spending millions of dollars on television advertising, 53.4 per cent of respondents answered ‘yes’ with 45.2 per cent answering ‘no’.

While Hostplus moved quickly to withdraw its sponsorship of the Storm in the wake of the salary cap scandal, its chief executive, David Elia, appeared to leave open the possibility of entering into other sponsorship arrangements in the future.

His statement described the fund’s association with the Melbourne Storm as having been “a successful and long-standing partnership” but added “the gravity of the reported conduct of the Melbourne Storm made the

relationship untenable”.

“Hostplus has at its core a commitment to the highest standards of governance. We believe in rigid accountability and continuous transparency, and the revelations about the actions of some members of the Melbourne Storm management contradict everything we believe in.”

However, Elia’s statement finished on this note: “We are confident the Storm can establish the necessary governance practices required. We remain committed to organisations that share our values of honesty, transparency, integrity and trust. These are the sorts of organisations that we will partner with.”