AUSfund has again emerged as the top-rated ERF as assessed by the Heron Partnership – but the research also suggests that some other ERFs remain problematic for members.

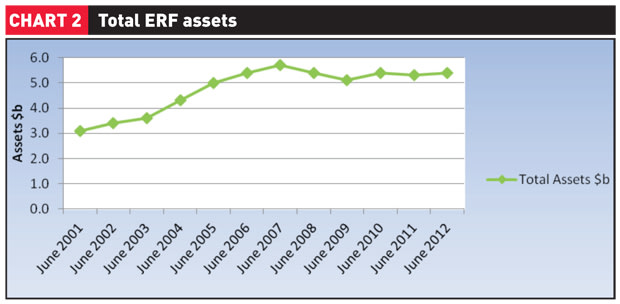

Superannuation accounts held in Eligible Rollover Funds (ERFs) have remained at over $5 billion for the past six years, despite the best efforts of successive governments and the industry to rectify the problem.

However the implementation of the Government’s Stronger Super and the advent of auto-consolidation is expected to make a difference.

The degree to which the amount of money tied up in ERFs remains problematic has been highlighted in annual research undertaken by specialist consultancy, the Heron Partnership, which has reported that the combined assets in ERFs at the time of its latest assessment stood at $5.35 billion.

Heron Partnership managing director Chris Butler said this compared with the peak of $5.7 billion recorded at June 2007.

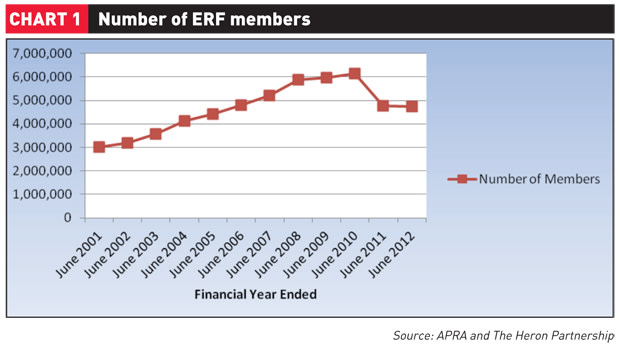

He said that over the past year there has been a 1.2 per cent increase in assets, but a decrease in the number of members by 0.29 per cent.

“We expect some significant further decreases in both assets and members over the next 12 months as the auto-consolidation impact will begin to take effect,” Butler said.

The Heron research pointed to a slowing in the reduction of ERF accounts, noted that the 0.29 per cent reduction in the past 12 months compared to a 22 per cent reduction in the previous year.

In a finding possibly due to the steady dynamics in the ERF arena, the Heron Partnership’s latest research revealed little change with respect to the leading ERFs, with the industry super-backed AUSfund once again emerging as Heron’s top-rated entity.

It was the seventh consecutive year that AUSfund topped the Heron ratings, but Butler acknowledged that the Commonwealth Bank-backed SuperTrace had provided strong competition over the past 12 months.

“We are very pleased to congratulate AUSfund on being assessed by us for the seventh occasion as the Top Rated ERF Product,” he said.

“Our congratulations also go to SuperTrace, which almost achieved the same rating score as AUSfund, Australian ERF and AMP ERF for being awarded five stars.”

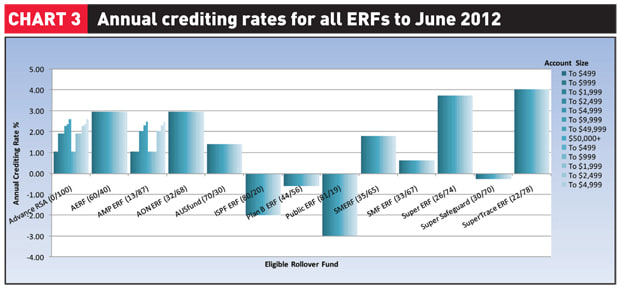

The research noted, however, that SuperTrace had achieved the highest declared crediting rate of all ERFs with 4.03 per cent, whilst the lowest return was -2.99 per cent by the Public ERF.

Heron noted that the two funds had different risk profiles, with SuperTrace being a conservative fund with an approximate growth/defensive asset weighting of 20/80, and the Public ERF being a growth fund with an 80/20 weighting.

It said that in an ERF, the fees deducted from the member account could not exceed the interest credited.

“This means for many small account balances, the fee will take all of the interest,” the Heron analysis said. “This gives some alarming results, showing that it is very unlikely that many of these accounts will ever grow with interest.”

The Heron analysis said there were only seven ERFs that deducted fees from the member account (ignoring transactional type fees such as exit fees, family law fees etc).

“The benefit of this structure of fees is that the actual fees are more visible (not hidden through asset-based deductions prior to determining the crediting rate) and do apply protection rules to this layer of fee.

"Funds that charge a flat dollar administration fee will have varying results; an asset-based fee is well suited, and is even better suited when that has a dollar cap on it.”